Our climate impact

Climate change is one of the most urgent challenges facing our society

As one of the largest financial companies in the Netherlands, we recognize the impact – positive and negative – that our business can have in the global climate challenge. That is why we are an enthusiastic signatory of the Dutch Climate Agreement, and we are committed to supporting the transition to a climate-resilient and net-zero economy with our Climate Action Plan.

Our climate impact

We want to play an active role in the global climate challenge. This starts by understanding the impact that our business has on climate change. By measuring the greenhouse gas emissions generated by our business operation or financed by our investing decisions, we can make informed decisions about how best to improve our climate impact. We have been actively measuring and reporting on these emissions since 2019. You can see the results below, highlighting our progress on the path to net zero by 2050.

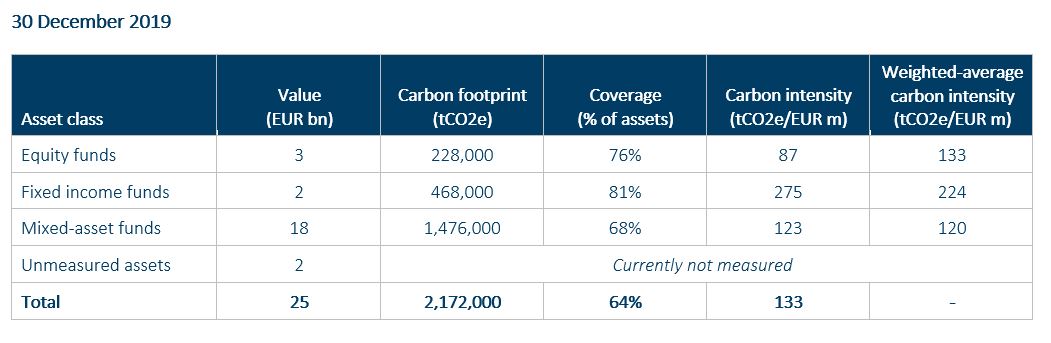

Emissions generated by our operations

For our business operations, we can currently estimate the greenhouse gas emissions resulting from the gas and electricity we consume to heat and power our office buildings. We can also estimate the emissions resulting from the limited number of flights we take each year for business purposes. In the future, we would like to extend our reporting to cover greenhouse gas emissions generated by other operational activities, such as traveling by rail for business purposes or employee commuting.

Since the end of 2019, we have significantly reduced the amount of greenhouse gas emissions that are generated by our business operations. As at 31 December 2021, our operational greenhouse gas emissions were down by around 35% – well ahead of our target to reduce these emissions by 25% before 31 December 2024. We are now well on our way towards our next target: reducing operational greenhouse gas emissions by 50% by 31 December 2029. Part of the reduction is due to energy-saving measures we have implemented across our offices. Part is also due to the structural change in the way we work as a result of the COVID-19 pandemic. All of our employees now work in a hybrid way, spending around 50% of their time working from home and 50% working from the office. We also make greater use of technology to connect with each other and our clients. This greatly reduces the number of flights we now take to meet with clients and colleagues in other locations.

Emissions financed by our investment decisions

We make use of guidance from PCAF when estimating the amount of greenhouse gas emissions financed by our investment decisions. The latest version of PCAF’s guidance provides methodologies that allow us estimate the greenhouse gas emissions financed by investments in listed equity, corporate bond, real estate and mortgage investments. We also make use of our own methodology to estimate the emissions from government bonds. Together, these methodologies currently allow us to estimate greenhouse gas emissions associated with between 80-90% of the investments we make for our own account or on behalf of our customers. We plan to measure the remaining 10-20% of assets when sufficient data and measurement methodologies become available.

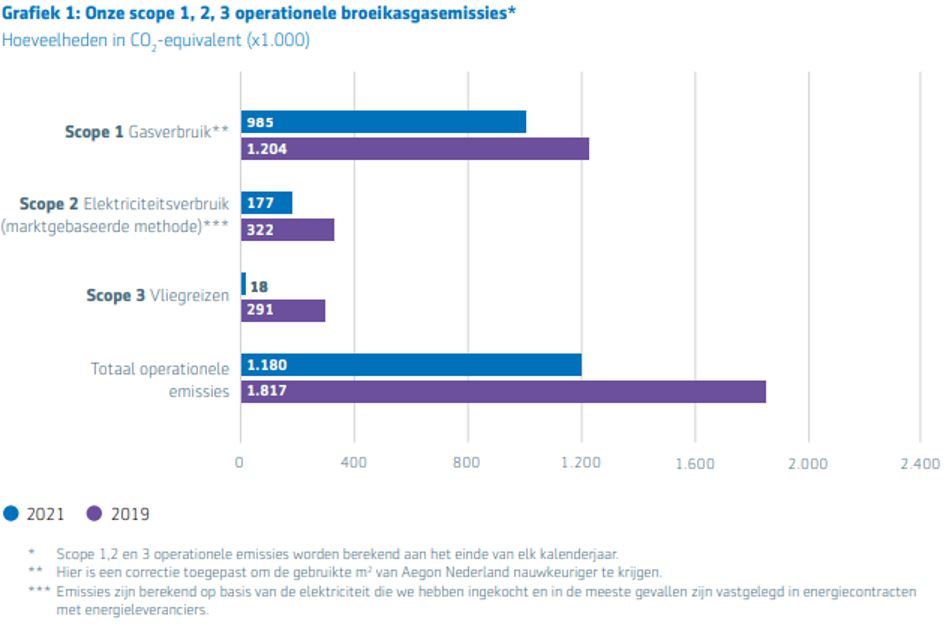

Investments made for our own account

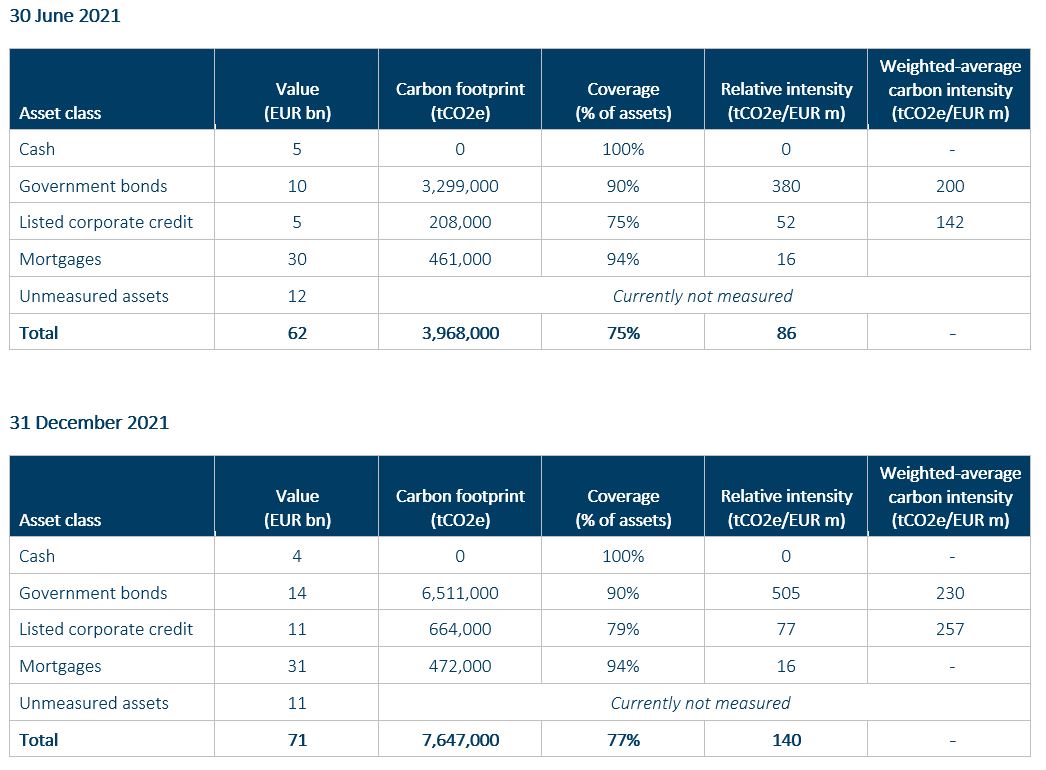

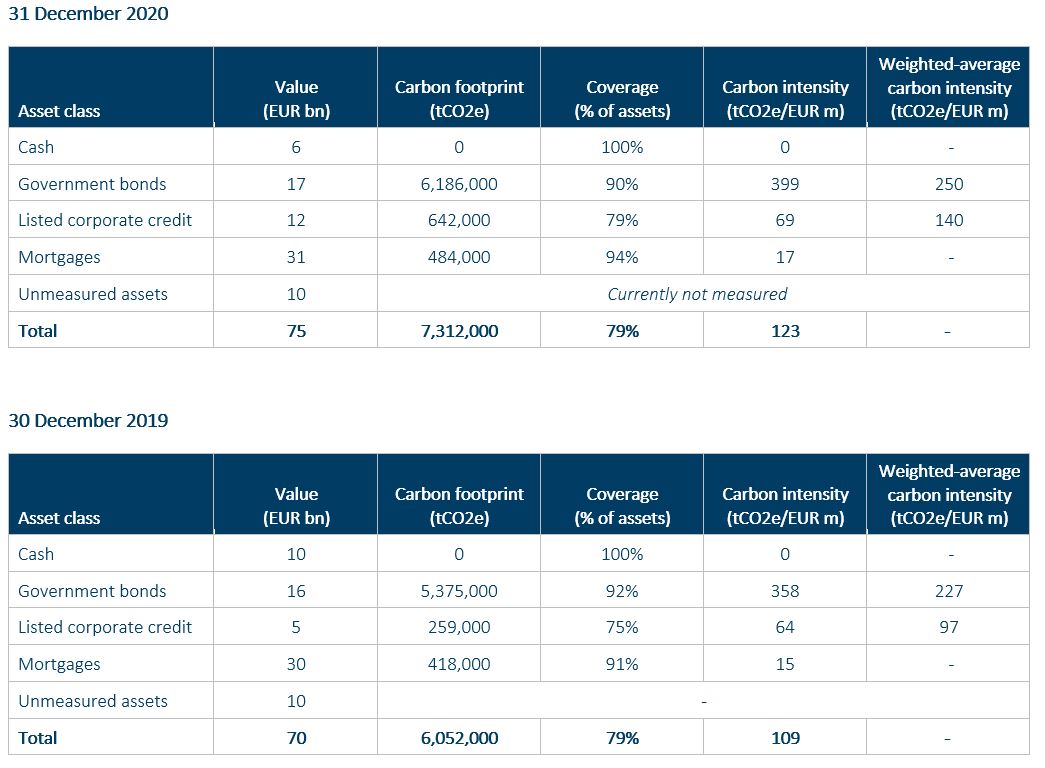

We take the insurance premiums and pension contributions that we receive from our customers and invest them in a wide range of different assets. We do this for own account, meaning that any profits (or losses) from these investments belong to us. We use the profits from these investments for a number of purposes, such as paying good pensions to our customers when they retire or covering the costs of damage to their homes from flooding. The following chart shows how the total amount of greenhouse gas emissions financed by these investments has changed over time. It also shows how the different asset classes, such as government bonds or Dutch residential mortgages, have contributed to our overall footprint.

As at 30 June 2022, the total amount of greenhouse gas emissions financed by investments made for our own account had fallen by around 34% since the end of 2019 – ahead of our target to reduce these emissions by 30% by 31 December 2024. The significant reduction during 2020 is driven by asset allocation changes we made in response to changing market conditions, and steps we took across different asset classes to improve our climate impact.

Additional information as at each measurement date can be found by selecting the date of interest below.

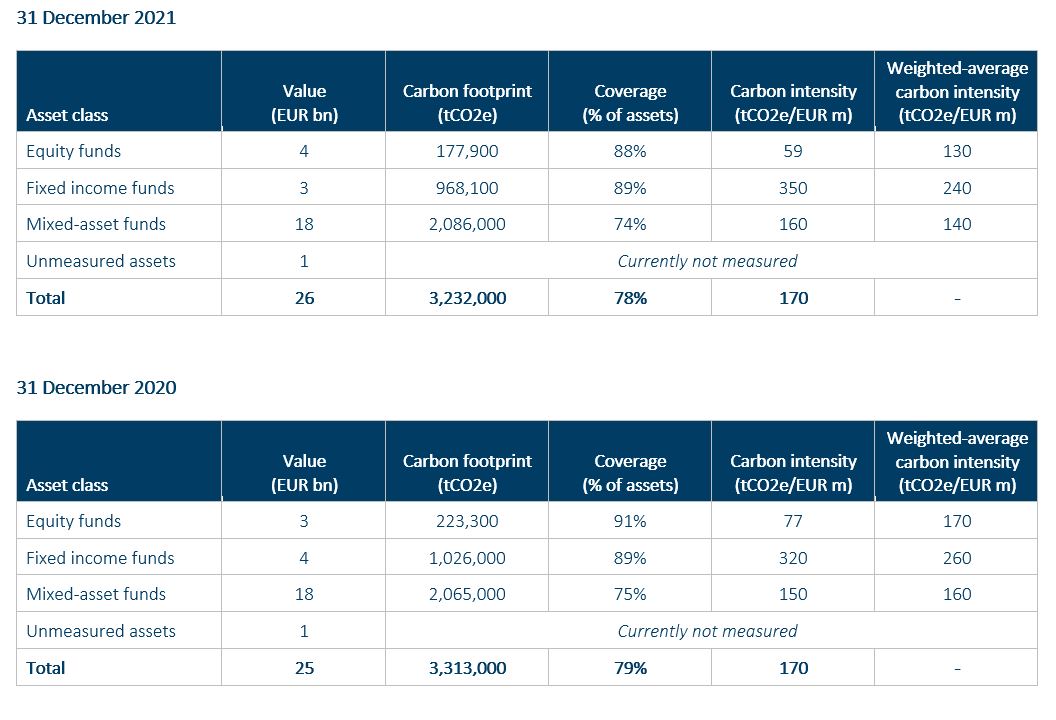

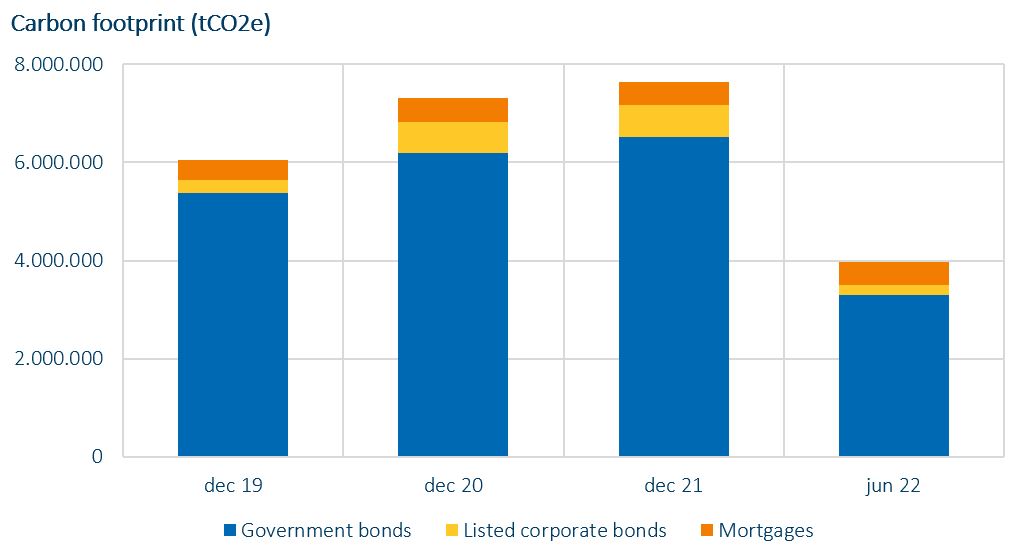

Investments made on behalf of customers

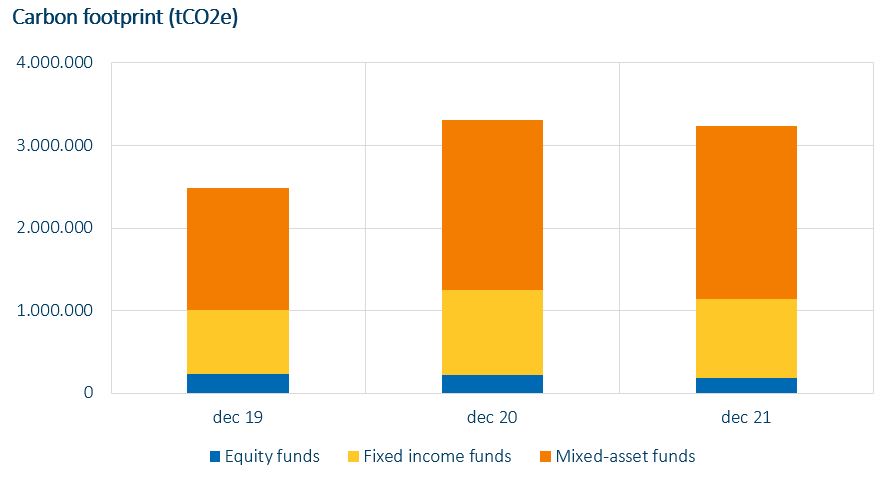

We offer a wide range of products to customers that allow them to save and invest for a variety of reasons, such as buying a house or receiving a pension in the future. Many of these products allow our customers to invest in a range of funds where we, or an appointed asset manager, make investment decisions on their behalf. The following chart shows how the total amount of greenhouse gas emissions financed by our customers’ investments in these funds has changed over time.

Additional information as at each measurement date can be found by selecting the date of interest below.